Daily Telegraph Front Page 11th of May 2024

The Daily Telegraph features former Labour leader Lord Neil Kinnock’s caution that despite leading in the polls, the party hasn’t yet won voters’ hearts.

The Daily Telegraph features former Labour leader Lord Neil Kinnock’s caution that despite leading in the polls, the party hasn’t yet won voters’ hearts.

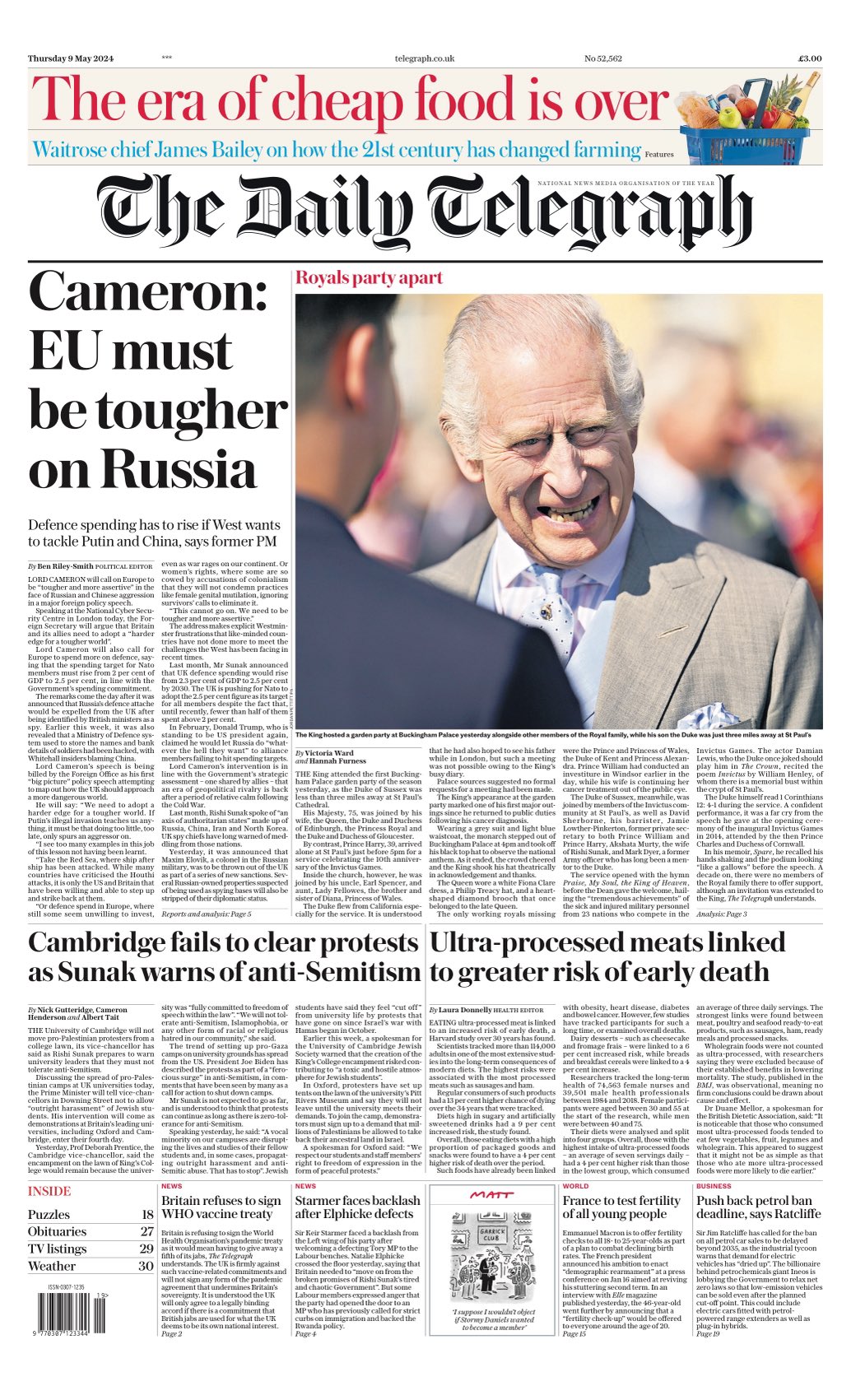

The Daily Telegraph reveals Lord Cameron’s urging for a more assertive EU stance against Russian and Chinese hostility.

The Daily Telegraph reveals Ofcom’s plans for stringent age checks that could exclude children from social media.